20 Business Deduction 2025 - 20 Business Deduction 2025. Small businesses, with aggregated turnover of less than $10 million, can immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 july 2023 and 30 june 2025. $20,000 threshold from 1 july 2023 to 30 june 2025 (no extension to medium sized businesses) and revert to $1,000 from 1 july 2025; 25 Small Business Tax Deductions (2025), Available for businesses with an aggregated annual turnover of less than $50 million, it.

20 Business Deduction 2025. Small businesses, with aggregated turnover of less than $10 million, can immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 july 2023 and 30 june 2025. $20,000 threshold from 1 july 2023 to 30 june 2025 (no extension to medium sized businesses) and revert to $1,000 from 1 july 2025;

Deductions For Business Expenses 2025 Elane Harriet, Bonus 20% deduction for small business investment in skills and technology.

Top 20 Business Deduction Guide for Small Businesses CARICHAM, Freelancers can deduct up to 20% of their taxable income from their taxes, though the qualified business income deduction is phased out at higher income levels.

Iowa Standard Deduction 2025 Jayme Melisse, Qualified business interest (qbi) deduction:

Tara stauffer, cpa pantoja ppt download, Specifically, since tcja cut the top combined tax rate paid by corporate shareholders (i.e., the top corporate tax rate plus the top rate on qualified dividend payments).

20 Biggest Business Tax Deductions Business tax deductions, Business, Eligible assets or upgrades will.

Qualified Business Deduction 2025 2025, The 20% qualified business income (qbi) deduction introduced in the 2025 tax cuts and jobs act continues in 2025.

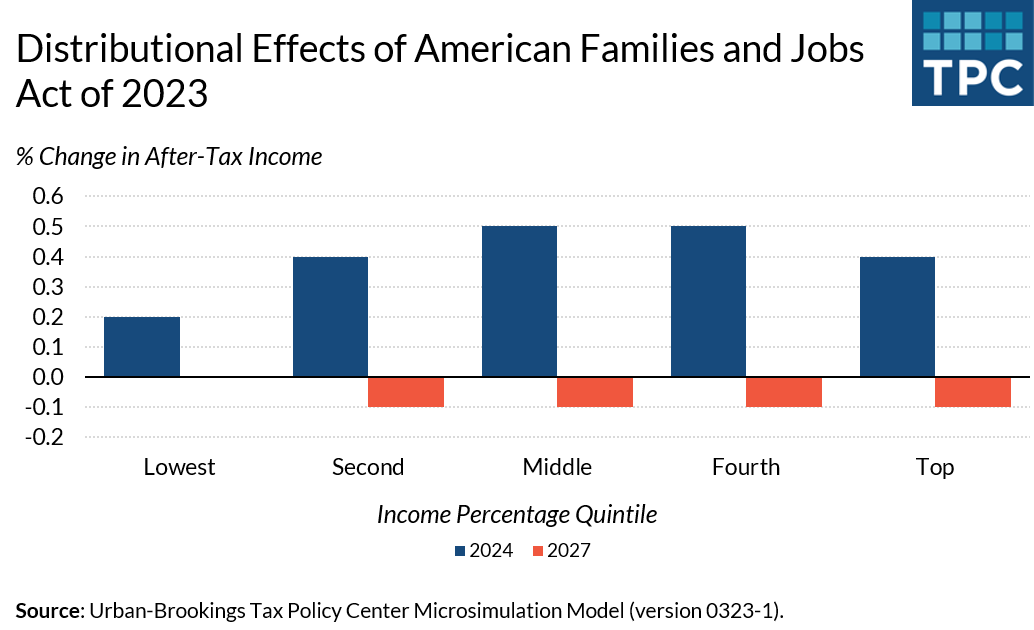

Tax Policy Center on Twitter "A House GOP tax plan would raise the, To qualify, a business must have an aggregated turnover of less than $10 million to immediately deduct the full cost of eligible assets up to $20,000.

To qualify, a business must have an aggregated turnover of less than $10 million to immediately deduct the full cost of eligible assets up to $20,000. Your standard deduction is the amount of income the federal government lets you keep 100 percent of.

Standard Deduction 2025 Piers Parr, A survey by the small business majority in august found.

Single Deduction 2025 Magda Roselle, Simplified depreciation rules for small business include: