529 Annual Contribution Limits 2025 - 529 College Savings Plan Limits 2025 Lily Mitchell, In 2025, gifts of up to $18,000 a year for an individual and $36,000 for a couple are not taxed. Contribution Limit For 529 Plan 2025 Rosy, Most of these rules are pretty straightforward.

529 College Savings Plan Limits 2025 Lily Mitchell, In 2025, gifts of up to $18,000 a year for an individual and $36,000 for a couple are not taxed.

529 Yearly Contribution Limit 2025 Kacey Mariann, Beneficiaries are allowed to roll over up to $35,000 over their lifetime into a roth ira in their name (not the original 529 account holder’s name).

New 529 Plan Rules 2025 Changes Rona Vonnie, Each state’s plan has different 529 contribution limits and tax benefits for its residents.

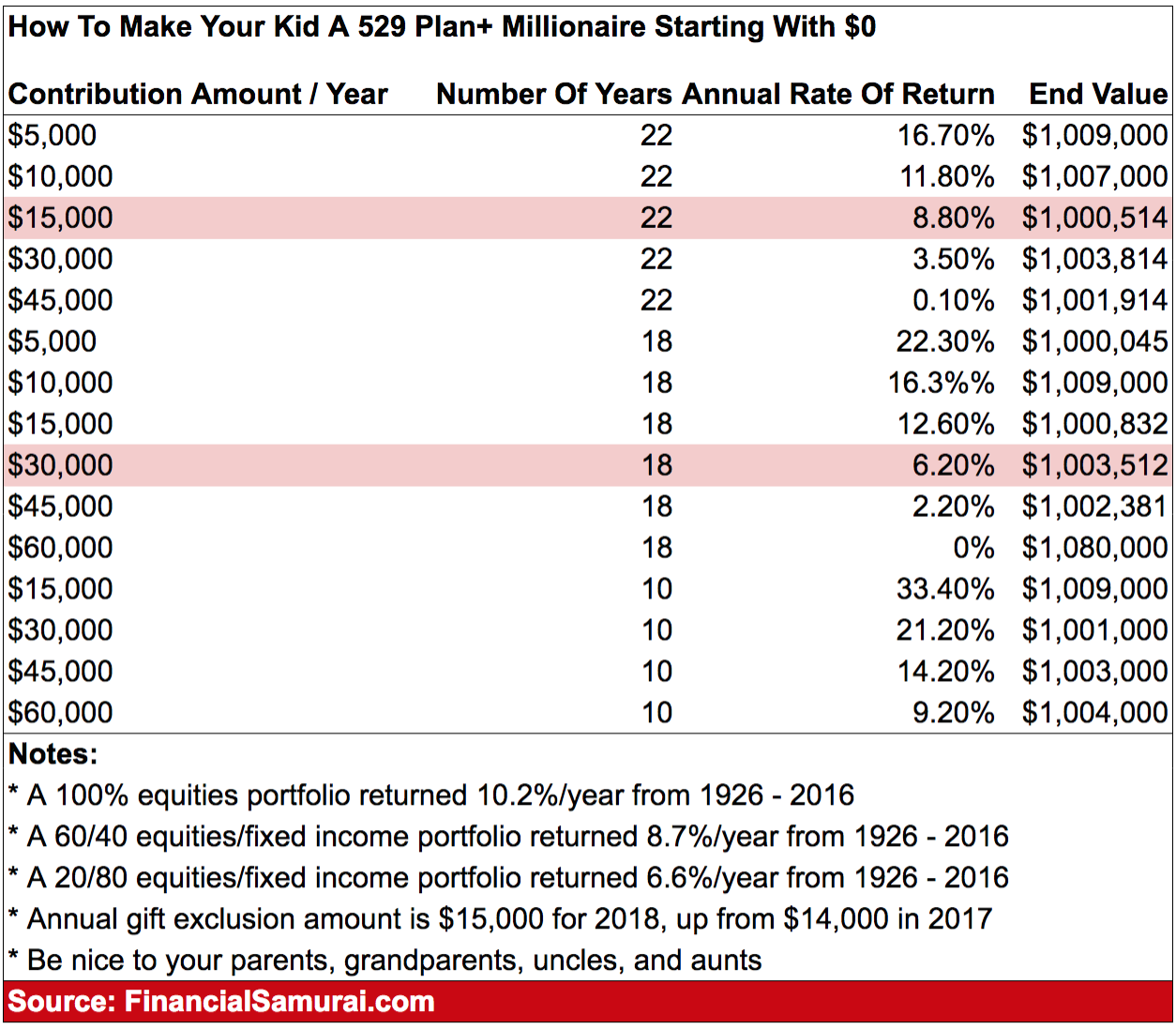

This limit is subject to the annual roth ira contribution limit, which is. You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits.

529 Annual Contribution Limits 2025. You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits. However, each state sets its lifetime contribution limit for 529 accounts per beneficiary, typically ranging from $235,000 to more than.

What is a 529 Plan Contribution Limit? Finance.Gov.Capital, Figuring out the contributions limits for retirement plans is pretty easy.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limit 2025 John Morris, You can contribute as much as you’d like to a 529 plan per year, but there are some caveats.

2025 Maximum 529 Contribution Tommi Gratiana, Most of these rules are pretty straightforward.

2025 529 Limits Avrit Carlene, You can contribute as much money as you want, but there are tax incentives to stay within the gift tax limits.

529 Yearly Contribution Limit 2025 Kacey Mariann, These limits typically range from $300,000 to $500,000, but some states may impose even higher limits.