Estimated Tax Withholding For 2025 - Irs Estimated Tax Payments 2025 Forms Luz Stepha, To estimate your taxable income, the calculator takes the gross income entered into the “income field” and then subtracts applicable deductions and adjustments, such as 401. If you don’t pay your tax through withholding, or don’t pay enough tax that way, you might have to pay estimated tax. Ohio Estimated Taxes 2025 Bryna Colline, This calculator is perfect to calculate irs tax estimate payments for a given tax year for independent contractor, unemployment income. Here's how to know if you're withholding enough.

Irs Estimated Tax Payments 2025 Forms Luz Stepha, To estimate your taxable income, the calculator takes the gross income entered into the “income field” and then subtracts applicable deductions and adjustments, such as 401. If you don’t pay your tax through withholding, or don’t pay enough tax that way, you might have to pay estimated tax.

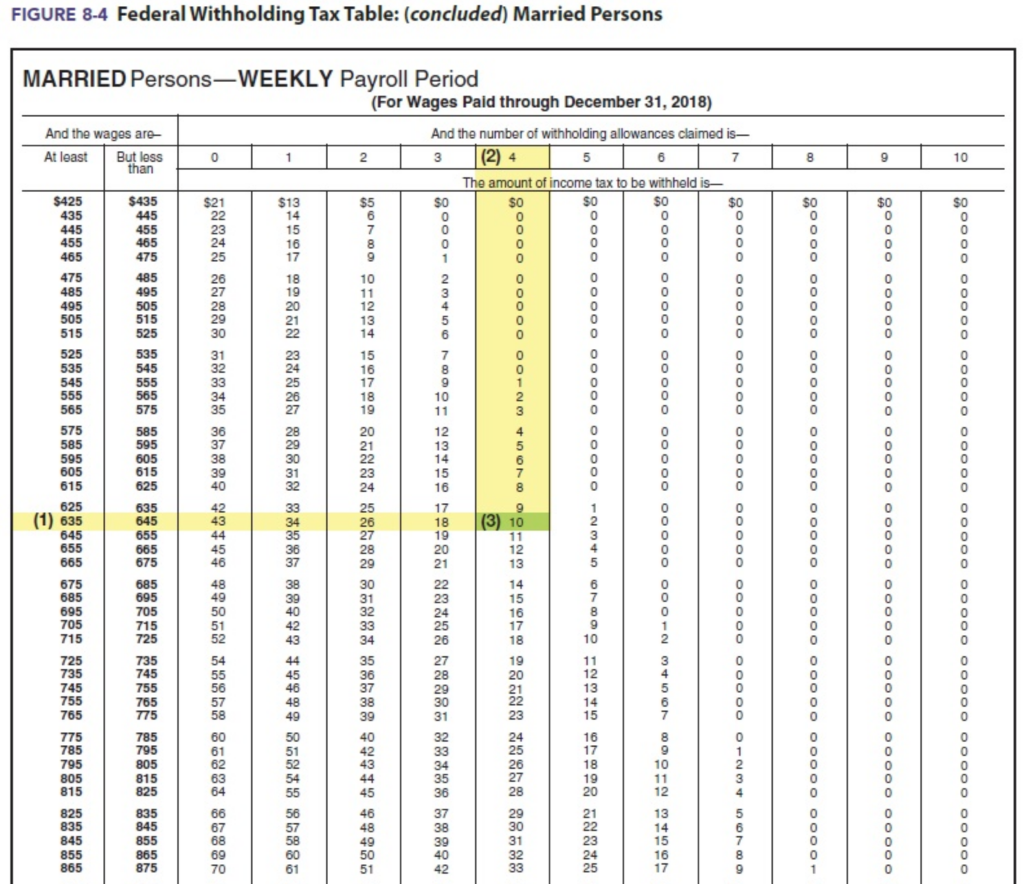

Updated Tax Withholding Tables for 2025 A Guide, Refer examples & tax slabs for easy calculation. When paying estimated taxes, you.

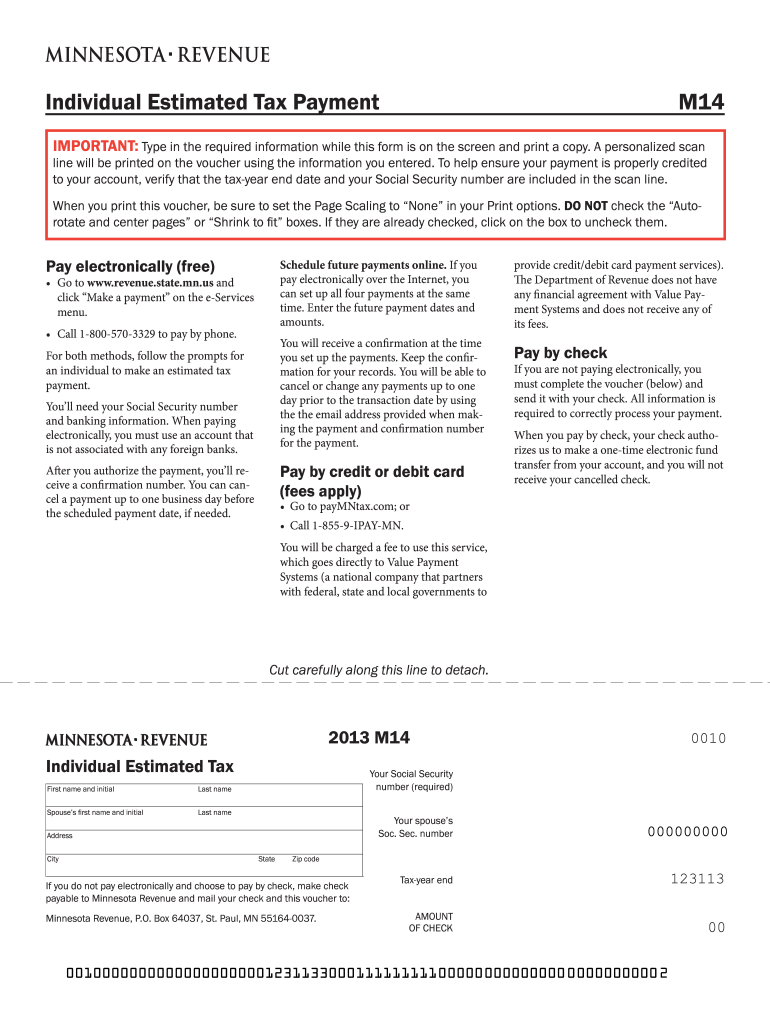

How Do I Calculate My Estimated Taxes For 2025 Hanny Kirstin, How many allowances should i claim. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2025 if both of the following apply:

The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home.

2025 W 4 Tax Form Printable Free Jaine Lilllie, You may have to pay estimated tax if you. What to do if you skipped an estimated tax.

Irs Withholding Form 2025 Pippy Brittney, For income earned in 2025, you’ll make three payments in. Determining the appropriate number of allowances to claim on your new york tax return is crucial to avoid underpaying or.

2025 2025 Estimated Taxes Free Dyana Goldina, When paying estimated taxes, you. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home.

Estimated Tax Withholding For 2025. Use h&r block's tax withholding calculator to estimate your potential refund. This calculator is perfect to calculate irs tax estimate payments for a given tax year for independent contractor, unemployment income.

People who are in business for themselves will generally have to pay their tax this way.

Withholding Tax Table 2025 Semi Monthly Nelia Wrennie, People who are in business for themselves will generally have to pay their tax this way. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

2025 Tax Calculator Estimate Irs Carlin Carolina, Refer examples & tax slabs for easy calculation. To estimate your taxable income, the calculator takes the gross income entered into the “income field” and then subtracts applicable deductions and adjustments, such as 401.